(Even) less is more: Takeover Panel confirms narrowing scope of the UK Takeover regime

The UK Takeover Panel has published its response to its consultation on companies to which the Takeover Code applies, which ran from April to July this year.

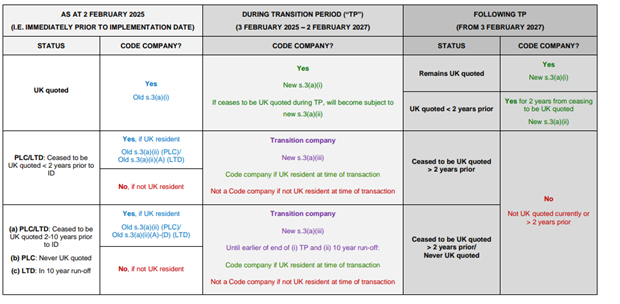

The scope of the Code has been narrowed significantly to focus on UK registered and listed companies (such terms defined below).

April 2024 consultation

The Panel published consultation paper PCP 2024/1 on 24 April 2024, setting forth a series of proposals (discussed by the SH Capital Markets team here) to refocus the basis on which the Code applies to companies registered in the UK, Channel Islands or the Isle of Man and whose securities are (or were recently) admitted to trading in one of those jurisdictions.

Responses to the consultation were received from nine respondents, which included The Investment Association, Quoted Companies Alliance and The International Stock Exchange Group Limited. The majority of respondents strongly supported the proposals.

The main point of contention was the length of the proposed transition and run-off periods. One respondent questioned the need for a run-off period altogether, citing a potentially disadvantageous impact on companies that were UK quoted but are, or become, admitted to trading overseas as the company would be subject to an additional layer of regulation (that other companies admitted on such overseas market would not). Other respondents, however, agreed that the Code should apply to companies which had recently cancelled the admission of their securities to trading and that a "run-off" period should apply.

Spot the difference

The Panel published its response (RS 2024/1) on 6 November 2024, taking on feedback from respondents. The main difference between the Code to be amended and the proposals relate to the length of the transition and run-off periods.

The transition period, being the period in which the previous Code will continue to apply to companies that do not fall under the ambit of the new Code, will now be for two years (not the three set out in its initial proposal).

Similarly, the period during which the new Code will continue to apply to previously UK-quoted Companies has been reduced to two years, rather than the three years set out in its proposal. This means that the new Code will apply to companies for two years from de-listing should a 'relevant date' occur within that period (i.e. the date of announcement of an offer or possible offer for the company, or other event with Code protection applications).

To whom will the Code now apply?

From 3 February 2024, the Code will now only apply to a company that is registered in the UK, the Channel Islands or the Isle of Man and either:

- the company is UK-quoted; or

- The company was UK-quoted at any time during the two years prior to the relevant date.

The panel has moved ahead with proposals to abolish entirely the residency test, meaning the place of a company's "central management and control" becomes irrelevant to questions regarding the application of the Code.

As a result of these changes, the Code will not apply to the following UK-registered companies:

- a public or private company which ceased to be UK quoted more than two years prior to the relevant date;

- any public or private company whose securities are, or were previously, admitted to trading solely on one or more an overseas markets;

- a public or private company whose securities are, or were previously, traded using a matched bargain facility (such as Asset Match or JP Jenkins);

- any other public company which is not quoted; and

- a private company which filed a prospectus at any time during the 10 years prior to the relevant date.

The panel have also clarified that the Code will not apply to companies whose securities are traded on private markets, secondary market/crowdfunding platforms, or the Private Intermittent Securities and Capital Exchange System (the latter which is expected to become operational in 2025).

Time to Prepare

As mentioned above, to accommodate for this marked reduction in the companies which are afforded the protections of the Code, the Panel has confirmed a transition period allowing companies that are subject to the Code- but which will not be protected by the revised Code- time to prepare for the new regime.

Governing this is a new Transitional Appendix which will be incorporated into the Code. This appendix provides for a period from the introduction of the new rule on 3 February 2025 and ending at 11.59pm on 2 February 2027 and will afford continuing application of the Code to companies which would otherwise no longer be "Code companies" once the new Code becomes effective. One important point to note is that any company which is a quoted company and decides to re-register as a private company during the transition period (which would result in the Code no longer applying to the company) seeks early consultation with the Panel so that it might provide guidance on the appropriate disclosure to be made to that company's shareholders.

Please click here to see the table in higher resolution.

During the transitional period, the Code will continue to apply to transition companies in the same way it did immediately before the implementation date; including the residency test.

The transition period will begin on the Implementation Date (3 February 2025), and cease to be effective on 3 February 2027.

Next Steps

The current arrangements will remain in place until 3 February 2025, and the two principal platforms which provide matched bargain facilities (Asset Match and JP Jenkins) have agreed to write to the UK registered companies whose securities are traded via their platforms to draw their attention to the implications of the amendments to the Code.

Transition companies should begin to consult with their advisers to consider what, if any, alternative arrangements need to be put in place once the Code no longer applies to them. If you have any questions about the scope of the new Code, or about how the Code will impact you, please fee free to get in touch with a member of our team at SHCapitalMarkets@shlegal.com.